Top 10 Issues for Hospital CFOs in 2021

Midway through 2021, hospitals have been forced to adapt to a constantly changing environment. Beyond market factors and shifting demographics, COVID-19 has altered the way care is delivered to communities across the country. Over the past year, hospitals have demonstrated laudable resilience as caregivers saved lives and delivered comfort to patients.

Chief Financial Officers play an important role in the health of a hospital. They walk a balance beam, ensuring continuous and sustainable care for the community. While frontline caregivers have shined bright during COVID-19, CFOs have been behind the scenes, becoming the unheralded heroes of the pandemic.

Sg2, the analytics arm for Vizient, has been monitoring the situation as it helps the industry stabilize, adapt, and evolve through expert intelligence, data-driven insights, and strategic perspective. In a recent webinar, 2021 and Beyond: Trends in Healthcare, experts from Morrison Healthcare, E15, and Sg2 touched on the importance of the hospital CFO and what issues CFOs are most concerned with for the remainder of 2021.

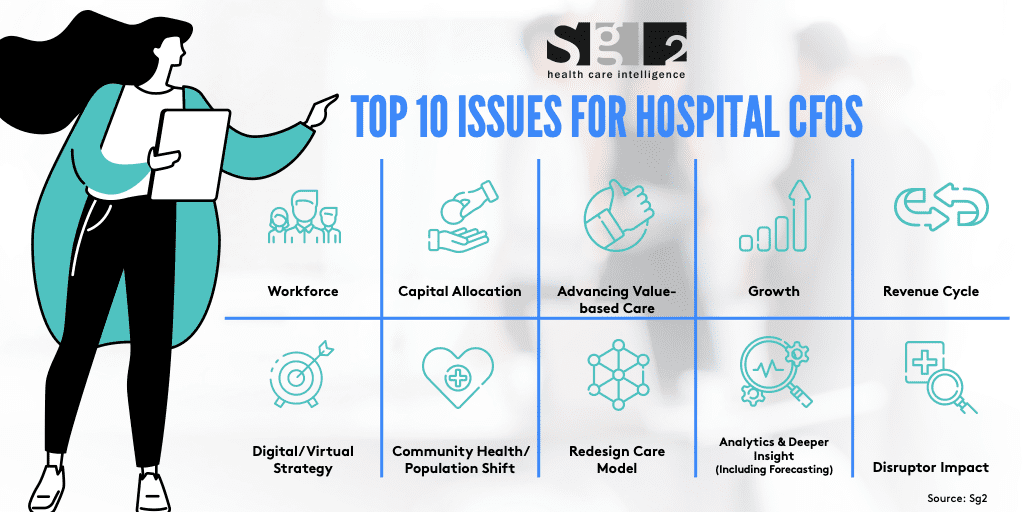

Top 10 Issues for Hospital CFOs

Workforce

CFOs are tasked with managing budgets and ensuring hospitals have the financial resources to put the proper care teams in place. COVID-19 has challenged caregivers and led to concerns about burnout. With an already competitive labor market, CFOs are managing difficult decisions about staffing and incentives. It’s an issue that will continue through the next decade as the nursing workforce ages and the next generation of caregivers look at their options.

Capital Allocation

For many hospitals, capital investments were paused during COVID-19 as additional strains presented themselves. CFOs are looking at timing and budget projections as they weigh the ability to dive into capital improvements. It’s a difficult decision to make. 2020 was a year of uncertainty. 2021 will be a year that tests CFOs as they make difficult decisions about financial investments and the future of facilities.

Advancing Value-Based Care

In today’s environment, healthcare is about providing value to patients. Value is the intersection of cost and quality. Hospitals are looking for solutions that build value and cement the facility as a destination of choice for patients. To advance value-based care, CFOs are looking for strategic partners who can provide customized solutions and a unique skillset to the organization.

Growth

Initially, COVID-19 halted hospital growth. Instead of focusing on growing services or building facilities, hospitals contracted their offering to ensure they could care for the rising COVID-19 census. With infection and hospitalization rates declining, CFOs are again looking for growth and opportunities to expand to new service lines and communities.

Revenue Cycle

Most hospital CFOs are laser-focused on the cash flow for their organization. In many ways, regulators have created a moving target for revenue cycle leaders. As a result, CFOs are taking a hard look at how payments are made, where revenue is coming from, and if they have the proper systems in place. This emphasis allows hospitals to remain financially viable, even in uncertain times.

Digital/Virtual Strategy

Telehealth has been in the background of healthcare for many years. COVID-19 brought it to the forefront as patients looked for new ways to receive healthcare without having to leave their homes. How hospitals handle new technology advancements and where they invest will define the industry for the rest of the decade. CFOs play a critical role in determining this strategy and paving the path forward.

Community Health/Population Shift

Over the past decade, healthcare leaders have seen their role expand outside of the four walls of the hospital. This has led to a well-documented shift toward population health. CFOs have a difficult job as the role of hospitals evolves. Going forward, they will find new revenue streams that safeguard the ability to provide care to the community both within and outside hospital walls.

Redesign Care Model

The way hospitals deliver care has changed. Beyond population health, hospitals are creating holistic patient care models that bring specialists together to create a comprehensive view of the patient experience. New care models are aimed at creating a nimble organization that delivers care quickly, efficiently, and effectively. The quest for value is a key driver in the development of new care models.

Analytics & Deeper Insight/Forecasting

There is more data in healthcare than ever before. In today’s market, data is critical to make planning and budgetary decisions. Many hospitals and CFOs develop relationships with key partners that can bring an added layer of analytics and analysis to their forecasting process. This helps to have a clearer view of the challenges and opportunities.

Disruptor Impact

COVID-19 served as a major disruptor to the healthcare industry, but it is not the only external factor that is driving change. There are new players entering the market which are creating new layers of competition. Regulators continue to move the target for hospitals, making accurate planning difficult. New technological advancements are changing the way healthcare is delivered and where hospitals need to invest. With so many disruptors in the market, CFOs must remain nimble as they chart the financial future of their organization.

The full webinar, 2021 and Beyond: Trends in Healthcare, is available on demand. Click here to gain access and hear more on what we’re expecting to see for 2021 and beyond.